Hookup Check: Your Ultimate Dating Resource

Explore insights, tips, and advice for modern relationships and hookups.

Get Rich Quick: The Allure of Instant Payout Systems and Why They Work

Uncover the secrets behind instant payout systems and why they captivate dreamers! Dive into the allure of get-rich-quick schemes today!

The Psychology Behind Get Rich Quick Schemes: Why We Fall for Instant Payout Promises

The allure of get rich quick schemes can be attributed to a complex interplay of psychological factors. Primarily, these schemes prey on our innate desire for financial security and success, capitalizing on the fear of missing out (FOMO). Many people, disenchanted with their current financial situations, are drawn to promises of instant wealth as they offer a seemingly easy escape from their problems. Instant payout promises create a sense of hope and urgency, stimulating our emotions and often clouding our judgment. Psychological principles such as the scarcity effect and anchoring bias further exacerbate this tendency, making these offers look irresistible and creating a sense of urgency to act before the opportunity disappears.

Additionally, individuals often underestimate the risks associated with these schemes due to cognitive biases, such as optimism bias and overconfidence. The initial success stories shared by promoters often reinforce the belief that these get rich quick schemes are legitimate paths to wealth. However, the reality is starkly different for many, as the overwhelming majority of participants end up losing their investments. Understanding these psychological triggers can help individuals become more discerning and cautious towards seemingly too-good-to-be-true financial offers. By recognizing the allure of instant gratification, one can cultivate a more realistic approach to wealth-building that emphasizes patience and strategy over impulsiveness.

Counter-Strike is a popular team-based first-person shooter that has captivated gamers since its inception. Players (often divided into terrorists and counter-terrorists) engage in tactical missions, and teamwork is crucial for success. If you're looking for some exclusive in-game benefits, be sure to check out the clash promo code for potential boosts and enhancements.

Fast Cash: Exploring the Mechanics of Instant Payout Systems

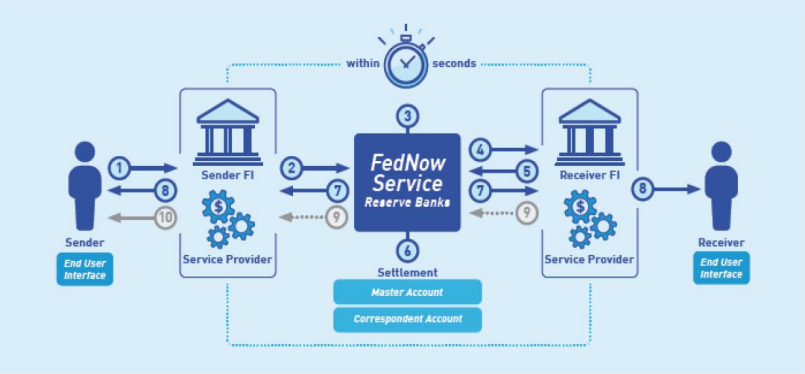

In the digital age, the need for fast cash services has surged, prompting the development of various instant payout systems. These systems are designed to deliver quick financial solutions, allowing users to receive funds almost instantly after completing a transaction. Typically, these services operate through sophisticated technology that securely processes payments in real-time, making them an attractive option for individuals facing urgent financial needs. By leveraging online platforms and mobile applications, users can bypass traditional banking delays, achieving financial freedom when time is of the essence.

Understanding the mechanics behind these instant payout systems reveals how they integrate with numerous financial institutions and payment gateways. Most systems utilize advanced algorithms to assess risk and streamline approval processes, which often means little to no paperwork. Common examples include services like PayPal, Venmo, and various peer-to-peer payment apps, all designed to facilitate rapid transactions. The allure of fast cash not only attracts individuals but also small businesses, who find these tools invaluable for immediate liquidity and customer satisfaction.

Are Get Rich Quick Schemes Worth the Risk? A Deep Dive into their Success and Failure

In today's fast-paced world, the allure of get rich quick schemes is undeniable. Many individuals are enticed by the promise of substantial financial gain with minimal effort, often leading them to invest their time and money in ventures that may not have a solid foundation. While a few schemes may have proven successful for some, it is essential to scrutinize these opportunities closely. A significant proportion of such strategies are fraught with risk, as they often rely on unrealistic expectations and lack sustainable business models.

Experts suggest that before diving into any get rich quick scheme, potential investors should conduct thorough research and consider the potential pitfalls. According to a survey conducted by the Better Business Bureau, approximately 70% of individuals who engage in these schemes ultimately lose their investments. This underscores the importance of approaching such opportunities with caution. In conclusion, while the potential for wealth can be enticing, understanding the inherent risks and doing proper due diligence can protect individuals from falling prey to scams.